Hello friends! 👋

This past week saw multiple instances of the all-watching government drop strikes on major crypto protocols and exchanges. And why shouldn’t they? If someone wants to keep certain aspects of their life private, mainly finances, it must be forbidden for the greater good, no?

“If you do not have anything to hide, why keep it private?” has been the scripted argument of officials for ages, passed from one bureaucrat to another. The choice of an individual is secondary much like the constitutional rights of a citizen when the equation boils down to: individual v/s establishment.

You’ve probably guessed by now what this is all about but let’s take a look into why this is important and some of the bottlenecks we’ve observed in ‘decentralized’ crypto.

Tornado Cash Ban

The U.S. Department of the Treasury’s Office of Foreign Assets Control (OFAC) sanctioned all properties of Tornado Cash (TC) that lie within the control of American entities. OFAC is responsible for enforcing sanctions (legal ban) against terrorist outfits, drug mafia, trafficking agents, or any other entity they deem harmful to the US.

Bypassing their regulations could land an American up to 30 years in jail or fines to the tune of multi-million $$$. OFAC is serious shit. No US citizen is allowed to visit/transact on the tornado cash website going forward. Let’s break down why this is a big deal.

What’s Tornado anyway?

Going by their Twitter bio, Tornado is a fully decentralized protocol for private transactions on Ethereum. In simple words, Tornado allows you to make private transactions by hiding the link between the payer and the payee which otherwise is open for the public to see and track (if they wish to). If you had a wallet that was publicly doxed, you could deposit your fund into tornado cash and then withdraw to another wallet without leaving a trace or code trail to track you down.

Why ban?

Given this medium works, it drew the attention of people looking to launder money or any other illegal stuff. However, deeming the technology that facilitates such transactions illegal is like blaming the human race for the fault of one man. All secure systems including Bitcoin started out as the preferred means of exchange for bad boys precisely because they were technically sound. Regardless of who uses the system, crypto serves as the best cross-country payment platform in the world. Let’s have a look at what the US department had to say in its press release.

In the image above, OFAC claims $7B+ worth of virtual currency has been laundered to date. This is pretty much the amount of all transactions made via Tornado. This is likely incorrect. Individuals used this platform for various purposes including making donations to global causes. A few months back, truckers in Canada went on a protest while their bank accounts were being seized/frozen. They turned towards crypto for donations and needless to say the floodgates opened up and it’s highly likely, that a bunch of them would have made use of TC for it. So any US citizen that participated or possesses funds coming from TC can be put on trial. Here’s Vitalik exposing himself.

A United Nations report states, “the estimated amount of money laundered globally in one year is 2 - 5% of global GDP, or $800 billion - $2 trillion in current US dollars.” This laundering takes place via the existing systems that function under the watch of big brother. The answer to whether or not it was right to ban tornado cash is hidden in the previous statement.

What are the implications?

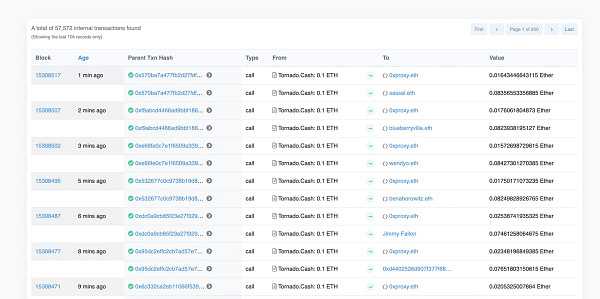

This is where it gets messy. Huge chunks of ETH, USDC, USDT, and WBTC have gone through TC and the stablecoins being centrally controlled can be blocked/seized at will. Circle (the company that issues USDC) has the ability to blacklist addresses that have received funds from TC. Let’s say someone rinsed their crypto using TC and they sent a USDC from TC to you, Circle has the ability to censor the USDC you’re holding! Given that anyone can send tokens to any Ethereum address, some people already started sending out TC flushed stablecoins and ETH to public figures since one of their public wallets was known to all.

Imagine someone sending one of those tokens to your wallet and you have to explain how you never used TC and that somebody else transferred it to your wallet. Sounds ridiculous, right? Well, someone actually went ahead and did that 😂.

But crypto is decentralized. How did they ban TC?

People often conflate decentralization with censorship resistance. Although decentralization is key to a global operation with minimal trust, censorship resistance is what prevents anyone from shutting down something.

Two American entities - Alchemy and Infura serve as node providers for anyone who doesn’t run a node themselves and that’s the majority of people. What this means is they were forced to censor requests and denied user access to Tornado Cash smart contracts. Although the smart contracts are uncensorable, without these providers, you cannot fetch data from the blockchain unless you run your own node. The cryptoverse should come to terms with this too. We either need more people to set up their own nodes (which seems unlikely at this point) or we need more node providers spread across the world. Some of these issues also reveal the blindspots of this ecosystem and in effect allow the space to grow stronger.

What’s in store now?

They’ve now started hunting down the developers who created an open-source tool for anyone to use. A suspected developer of Tornado has been arrested in the Netherlands!! It’s unimaginable how someone could arrest the creator of a platform and not the perpetrator. If they did that for all the scams and money laundering done via the existing system, we’d have a jail the size of a small country.

This move now puts developers in a tight spot. They will seek legal protection for creating code and the legal implications are beyond my understanding or knowledge. As Cobie said, the war on code has begun. Crypto is governed by code so this likely has massive ramifications and will drive anonymity/pseudonymity amongst users of the new internet. Privacy focussed blockchains such as ZCash and tokens like Monero could be next in line but will be interesting to see how far can they go along. Code forks are real and so are anonymous founders.

As I like to believe, all these sanctions, the collapse of the existing monetary systems across nations, privacy invasion, and new developments in crypto, the good, and the bad all are setting up the plot for the execution of Satoshi’s vision. If you know something is going to happen, you watch the current drama unfold as the necessary steps lead to the inevitable. Will be fun to watch!