Hello friends! 👋🏼

Happy Saturday! Some of you might be pumped about the IPL, some about the F1 race, and some simply about the weekend. Well, I’m pumped about the hottest topic in crypto: NFTs. This post is gonna walk you through what this is all about and how can you buy/sell and evaluate these projects. So let’s dive right into it 🚀

What is an NFT?

NFT stands for Non-Fungible Tokens. According to Merriam-Webster, ‘fungible’ means something that is interchangeable or capable of mutual substitution. So non-fungible obviously means something that is NOT interchangeable, i.e., unique. And token means an identifier or a currency that lives on a blockchain. Hence, an NFT means a unique identifier or currency native to a blockchain.

For example, the Indian Rupee or any other currency is fungible since the Rs 200 note you possess are the same as the one I possess and can be interchanged without a fuss. However, your passport is not interchangeable with mine hence it is non-fungible. The greatest myth associated with NFTs is that they are art or jpeg images only. This couldn’t be further from the truth. Any credential, identity proof, art file, digital real estate, domain name, etc you possess that is unique can be an NFT on a blockchain. It is simply that we’re living in a jpeg mania right now so it seems like all NFTs are art files. Here’s a short but funny video talking about NFTs. Do watch it!

Why NFT?

Any sane soul would ask: why do we need NFTs in the 1st place? Let’s look into the following reasons to understand why millions are being poured into it, why there’s a gold rush, and why the smarties are building it over the weekends.

NFT is a forward-looking solution, in essence, a use case is built out for a digital-first future. Let’s not confuse it with a solution looking for a problem. It is a no-brainer at this point that our lives are moving towards a digital-first environment. Some would argue we’re already there. So in a world, where someone’s geographical location is irrelevant and avatars become identities, the conventional system of identification and verification will fail. Right now, citizens rely on state-sponsored entities to perform verification and collaboration that is slow and non-internet native. NFTs allow verification on-chain and more importantly, digital ownership. You could right-click + save an image (NFT) but how do you prove ownership of it and how exactly will the economic value accrue to you if you do not own it? For those who think no one cares about ownership, they’re being forced to rethink. Twitter has already rolled out a feature to verify NFT ownership and Instagram is going to follow in the same steps. Spotify is next on the list. Sooner or later, all social media platforms will incorporate the feature so the right-click + save gang will only popularize the art, making the original piece more valuable.

NFTs are composable. The fact that these live on public blockchains add indispensable value in terms of security and composability. No one has ever been able to hack the bitcoin or Ethereum network and is unlikely to do so which adds a great layer of security to the digital asset. Composability is an overlooked feature in web3. You can move your assets across protocols, build on top of them permissionless-ly. This is not possible in web2. For example, your followers on Instagram or Twitter are not really your followers. You cannot move them to another platform or even download the contacts in a list. The value accrues to the platform and not the user. If you were to be banned or decided to move platforms for whatever reason, you lose everything you had. Avatars bought in Call-of-Duty cannot be moved out of the game to be used elsewhere. Heck, they can even get scrapped at the wish of a developer. NFTs are a solution for this. If we’re going to build a digital universe aka the metaverse, we need composability at the forefront.

Of course these are philosophical and technical reasons why NFTs exist in the first place but the use cases we’re seeing is quite different right now. Well, why are people buying million-dollar jpegs? The answer is social status and access to an exclusive community. What Lambos are in real life, NFTs are in digital life. For someone who thinks Lambos are simply cars, you have it all wrong. It’s more of flex or a status symbol than a car. Same is the case with NFTs.

You may or may not play golf but you certainly want a golf club membership, don’t you?

Another reason for the jpeg mania is the opportunity to make a quick buck. There is an innate human desire to make money with the least possible effort and for now, NFTs somewhat allow that. Last year, if you bought 1 Bored Ape for 0.08 ETH, you’d be sitting on millions right now. Here are some celebs who are members of the Bored Ape Yacht Club:

NFT Terminologies

Before we dig into cool projects, it’s good to understand the basic terminologies that’ll help us understand and evaluate these projects better.

Floor Price: The absolute lowest asking price for a piece of art in a collection. This keeps changing as the project gains/loses popularity.

Looks Rare: Technically implies the art is rare but is often used ironically.

PFP: Profile Picture. Most art NFTs are used as profile pictures on social platforms.

Generative Art: An art generated by computer algorithm in real-time. In some cases, the art is generated when you mint it so it’s a surprise for buyers too.

Yuga Labs: Owners of the Bored Apes, Mutant Apes, Cryptopunks, Meebits, and Autoglyphs.

1/1 of ‘n’: Refers to a unique art in a collection of ‘n’ similar (not same) art. The uniqueness is determined by attributes of the art. n >=1 in all cases.

Volume Traded: The total amount of Ethereum spent on buying/selling by the community on a specific collection.

Cool NFT projects

There are some pretty cool projects out there that I’ll list below. Buying these would be expensive but nonetheless gives you an idea of what to look out for.

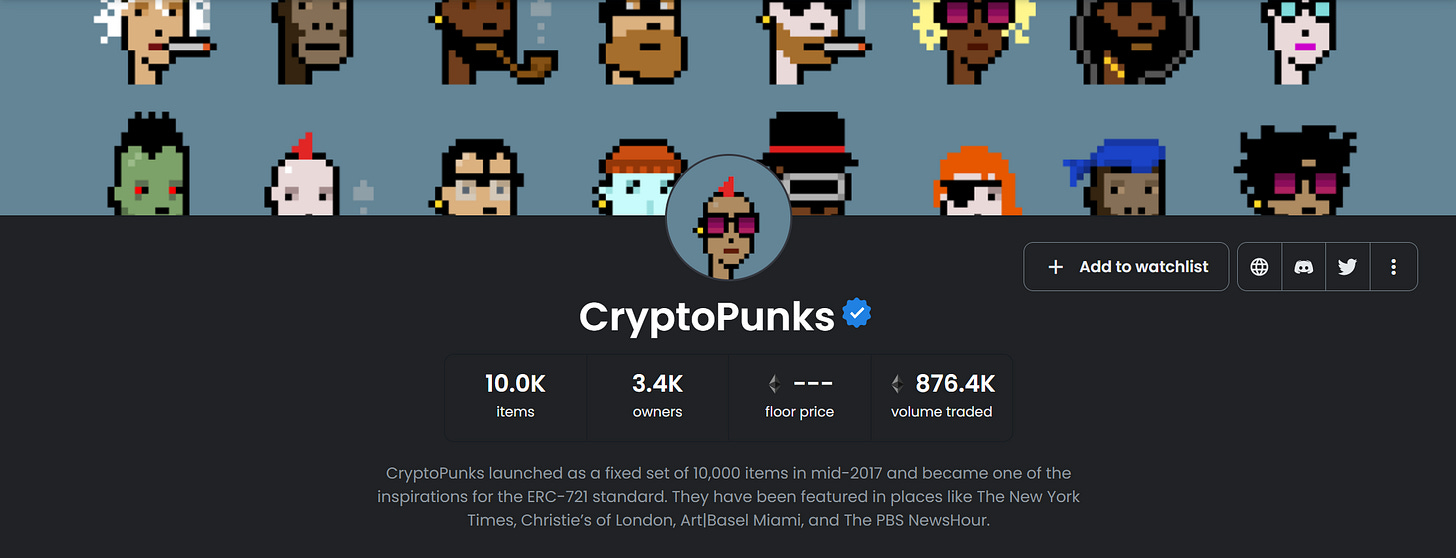

Cryptopunks - A 24x24 pixel art image generated algorithmically. Also referred to as the OG NFT collection on the Ethereum blockchain. The project has a strong community and derives its value from being the 1st in this space. In the screenshot below from opensea.io (a NFT marketplace), you can’t see the floor price because cryptopunks are traded on their website linked above.

Bored Ape Yacht Club - Currently the #1 NFT collection in the space by floor price and popularity. They have an extended lineup of real-life events for the community and roadmap for the future. This got leaked 👀 and you can see it here for yourself. The community members get early access to other NFT collections too which they can sell for a profit.

Azuki - One of the hottest projects that picked up steam recently after the launch. They’re trying to create a metaverse of their own which is basically a digital community with exclusive benefits and access for the members.

If you wish to explore in detail, head over to NFT marketplaces like Opensea or SuperRare to see some of the best collections on sale. Let’s now decode and see what makes a project valuable.

Marketing: I hope y’all have heard of ‘Fair & Lovely’, the magical cream that can lighten your skin tone in weeks or maybe days. Now imagine if I were the poster boy for the brand. Would anyone buy it? Probably not. Okay, definitely not! The fact that someone like Yami Gautam promotes it, adds value and hype to the brand and its products. It’s the same with NFTs too. However, there’s a key differentiating factor. If a celebrity is roped in before launch, it is likely a Pump and Dump scheme so be cautious before aping in. However, if the project gains traction and celebs ape in over time and talk about it publicly, the project is probably going up. This judgement is more art than science so you need to get the pulse and decide.

Community: Any project that doesn’t have a community raving about it is a red flag 🚩🚩🚩. Run away from it as fast as you can. No project in web3 has succeeded without a strong and organically grown community. Those DM’s you get on Insta and Twitter from anons shilling their project is not community growth but bots doing their job. Stay away from them. A good project will have active participation from the community on Discord, Twitter, Instagram and the ‘Activity’ on Opensea or other marketplaces will be helpful for you to form judgments.

Creators: Look who the creators of the projects are. Verified collections or creators are unlikely to dump on you so they’re better off than most creators. Sometimes brands try and take advantage of their brand name and dump useless NFTs on the community as well so you need to use your intuition to make decisions. Avoid FOMO.

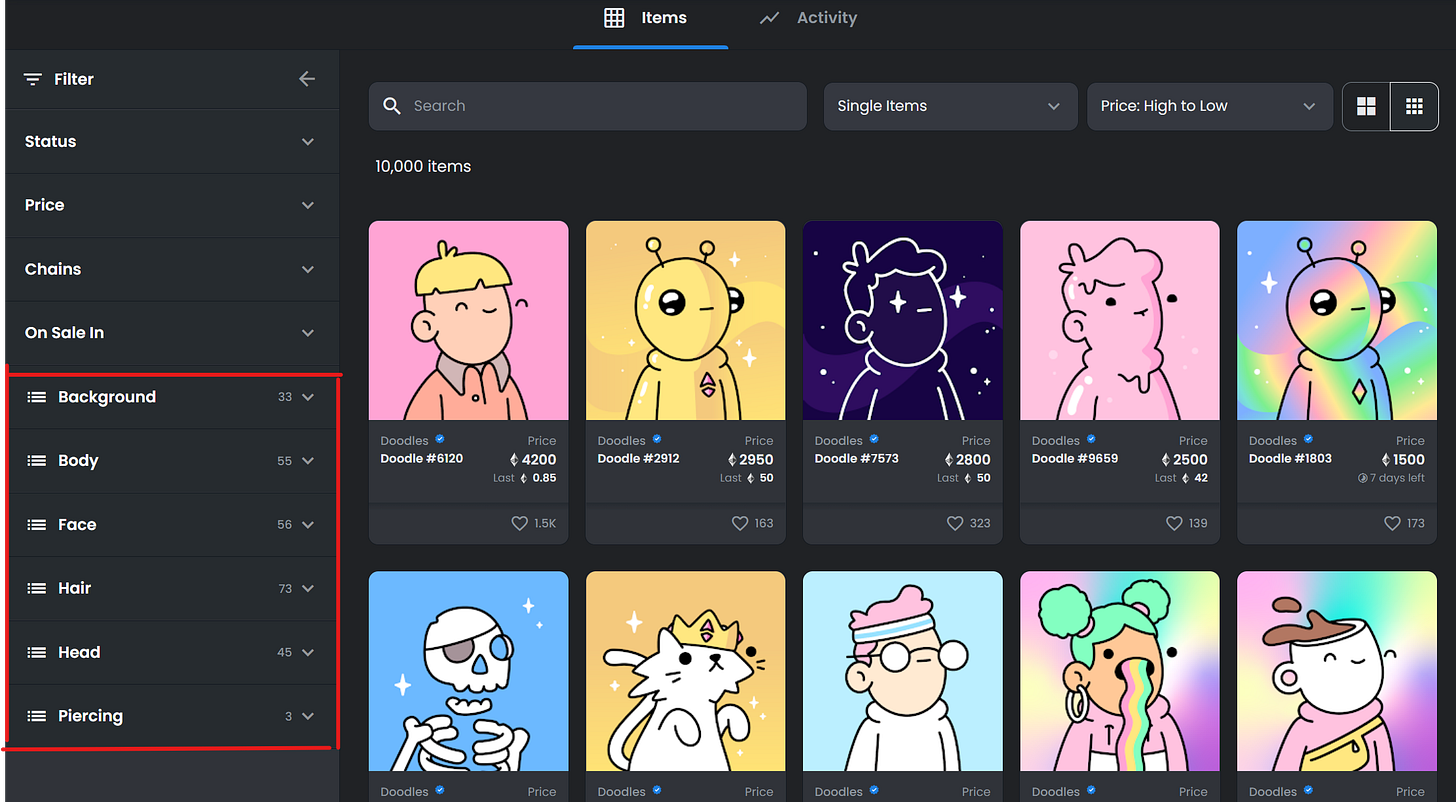

Okay, so now that you understand the surface level stuff, let’s now look at some stats. Check out the activity tab of a project on Opensea and you’ll see something like the image below. This one’s from the Doodles collection. You can change the filters on the left side of the screen and look at more data. Higher the activity, the more engaging the project is. There is no benchmark number to compare to but you should check out other projects to see how each performs relative to another.

The above factors are good enough to trickle down our way to good projects and now we’ll figure out how to pick the best art from the collection.

Properties: All the legit collections will have art that come with properties, i.e., features that define the art. For example, if you look at the Doodles collection, you’ll see characteristics highlighted in the red box. These characteristics have multiple properties. The number 33 next to ‘Background’ means there are 33 different types of background and if you click on it, you’ll see the variety of backgrounds available along with number of art files that have that.

Rarity: Looking at Doodle #2873, we can see it has 6 properties and the percentage of doodles that posses that property is mentioned next to it. This tells us about the rarity of the art. The lower the percentage, the rarer is that property in the collection, making it all the more valuable. Rarity.tools is a great website to check out how rare an NFT collection is.

Apart from these factors, people buy art they like and can relate to. If you’re going to spend your money on something, you better like it otherwise you’ll sell when liquidity dries up in short/long term and may not benefit from the monetary value it could generate.

In order to actually buy these, make sure you have enough ETH loaded up in your web3 wallet like Metamask. Add some surplus too (~0.01-0.07 ETH) to cover for gas fees (transaction cost) as well. Here’s a piece I wrote to get you up to speed with setting up metamask and loading it with crypto.

As someone said, the only way to enjoy and understand crypto is to live it and not simply read so go out there and experiment with small amounts of money. If you end up stuck with something, I’m always around so shoot me a reply or put it in the comments and I’ll get back as soon as possible.

I hope you enjoyed this post and learnt something new today. If so, consider subscribing and sharing with your friends. Until next time 🙋🏻♂️!