Hello friends !👋

Lots of interesting stuff happened in crypto past week. We’ll take a look into some of those then dive into the details of a super interesting protocol and decide if it’s worth investing in.

News Updates⚡

The bears are roaming wild with their claws out so I hope you’re not levered up and staying safe. At the time of writing this post (May 9; 11 pm), the data for the past 24 hrs is wild. Over $700M+ in liquidations! 🤯

Hope you rotated into the blue-chip tokens or stablecoins. If not, hodling is the next best option. This does look like a good time to stack coins over the next few weeks or maybe months (I’m doing it). The carnage could go on for a while so bi-weekly/monthly investments make a lot more sense than a lumpsum purchase. Here’s what the current crypto fear & greed index looks like. Some famous guy said: “Buy when there’s blood on the streets”. If you’re positive about the trajectory of this ecosystem and are investing on a long-term horizon, this should be an easy choice for you.

Now coming to some positive news - Instagram is all set to launch NFT verifiability on its platform. I have a feeling they’ll launch a marketplace too in the near future because that’s where they get to make money. This is huge and could possibly be the beginning of NFTs going mainstream!

If you’re new to NFTs, check out the article below I wrote to go from 0 → 1. Good time to cover the basics before the normies start talking about it.

Alright, coming to the central theme of this essay. People often talk about blockchains not having mass-scale usage or general life applications so I picked up a protocol that seems to be doing it and we’ll do a brief analysis on what, why, and how it works.

Helium: Introduction

Back in 2015, the CM of West Bengal announced public WiFi hotspots that would cover the entire city of Kolkata to fulfill the ambitious plan of turning it into a WiFi-enabled city. The project took off with great enthusiasm but eventually fell flat. The major reason for the failure was poor economic incentives or perhaps lack thereof. The state government was spending money to provide the services to the citizens and there was no shortage of freeloaders so this eventually had to end.

Helium is a blockchain-powered protocol that offers long-range, low-power connectivity for IoT devices (not smartphones). They seem to have found a business model for running a decentralized and distributed connectivity platform. Instead of spending VC money on setting up hotspots to gain users, they incentivized users to buy and set up hotspots and rewarded them with their native token $HNT for using the network which could then be traded on exchanges. The use of blockchain enables them to operate this communication infrastructure at low costs and adopt a business model different from the incumbents.

Helium’s three co-founders Amir Haleem, Shawn Fanning, and Sean Carey started the company in 2013. Haleem has an active eSports and game development background. Fanning, by contrast, is well known for developing Napster, the music-sharing service which was one of the first mainstream peer-to-peer (P2P) internet services in the late 1990s. Carey meanwhile held multiple development roles prior to Helium, which included advertising optimization firm Where, acquired by PayPal.

If you love to learn from videos, here’s a short one (<3 min) from Helium themselves, explaining what they do.

Innovative Strategy

The industry-standard approach to establishing a telecom network would be to participate in an auction, lease or rent land to set up towers, purchase high-end expensive equipment, and maintenance of that equipment. This is capital intensive and new players often get priced out of the market. Helium’s innovative strategy gives it a competitive edge.

The fixed cost of buying a hotspot is low ($350-$500) and is expected to drop even further as Chinese manufacturers have started creating clones which will drive down prices. Helium, interestingly, benefits from this approach as it doesn’t intend to sell the hardware at a premium. Allowing 3rd party manufacturers to get into the space implies user growth would accelerate. All this without having to spend money on creating and buying equipment. It is the users who pay for these hotspots and not Helium itself.

People who own and run hotspots are paid in real-time in HNT since all computations happen in real-time on a public blockchain. Automated micropayments lead to fast and efficient payouts. The onboarding process is much simpler compared to trad methods of providing data to telecom cos and waiting for a set period of time for activation.

On the technological front, the native blockchain uses a novel sybil resistance mechanism - Proof of Coverage unlike Proof of Work used by Bitcoin, Ethereum, and other networks. The chief aim behind using this mechanism is to prove -

that miners are operating compatible hardware and firmware

that miners are in the geography they claim to be in

resolve conflict when presented with conflicting data for achieving consensus

All one needs to do to fire up the device is to plug it in and connect to your local internet via the helium app. It uses radio waves that can travel across walls and over long distances and reach the destination as long as there is constant coverage. This is to power the IoT devices so interconnectivity across cities and states can be achieved provided enough hotspots cover the region. What this means is you could monitor your devices while sitting in a different city altogether for very low cost and energy consumption. Here’s what the global coverage looks like as of now.

The growth of hotspots has been on a positive uptrend. In fact, the growth has been bottlenecked by supply-chain issues. The demand for these hotspots far exceeds the supply so it is fair to expect growth over the coming months. Here are some stats on the current state of hotspots:

Real-life Usage

According to Multicoin Capital, one of the largest investors in Helium, a few use cases already exist but a majority of them will come up once people start using the network in their native and unique ways. Some of the current use span-

Pet tracking: The pet industry in the US is huge and tracking is a problem still unsolved. Helium with its city-wide connectivity and low power hardware makes it technologically and economically feasible for pet owners to put trackers that run on the helium network. It is estimated to cost as low as $1 per month to operate. With over 200M+ pets in the US, this single use-case could spur the advancement of the network.

Smart City Infra: Inefficient traffic control contributes to wasted time for commuters each day so a low-cost, long-range network that allows traffic junctions to communicate with each other could improve traffic flow in the city.

Last-mile mobility could be improved using this network. Data transmission and location tracking for vehicles, especially bicycles and low-powered vehicles could improve the consumer experience of owning such vehicles.

Looking from a skeptics lens, one could argue that users are incentivized to run these hotspots simply to earn the HNT token which they can sell on the secondary marketplace for a profit. The incentives are structured in a way that people would adopt the usage of hotspots in the hopes of earning a profit within a month. Given the protocol started gaining traction in late 2020, we’ll have to wait and observe what the community ends up doing with this infrastructure.

Metrics

There is an inherent difficulty in evaluating a crypto protocol based on metrics as we do for stocks for 2 reasons-

Most crypto protocols are like early-stage startups that optimize for growth and have a lot of hype and speculative activity around them. Using ratios to evaluate might not be the best way to form an opinion.

The tokenomics and business model of these protocols are completely different from that of traditional companies.

However, there are some metrics that do give us a baseline idea of their performance. There are numerous ways to interpret them and I’ll leave that to you. Some of those metrics would be-

Revenue generated for the tokenholders

Revenue generated for the protocol

No. of daily/monthly active users on the platform

Active wallet holders and the token distribution

Trading volume (daily/monthly)

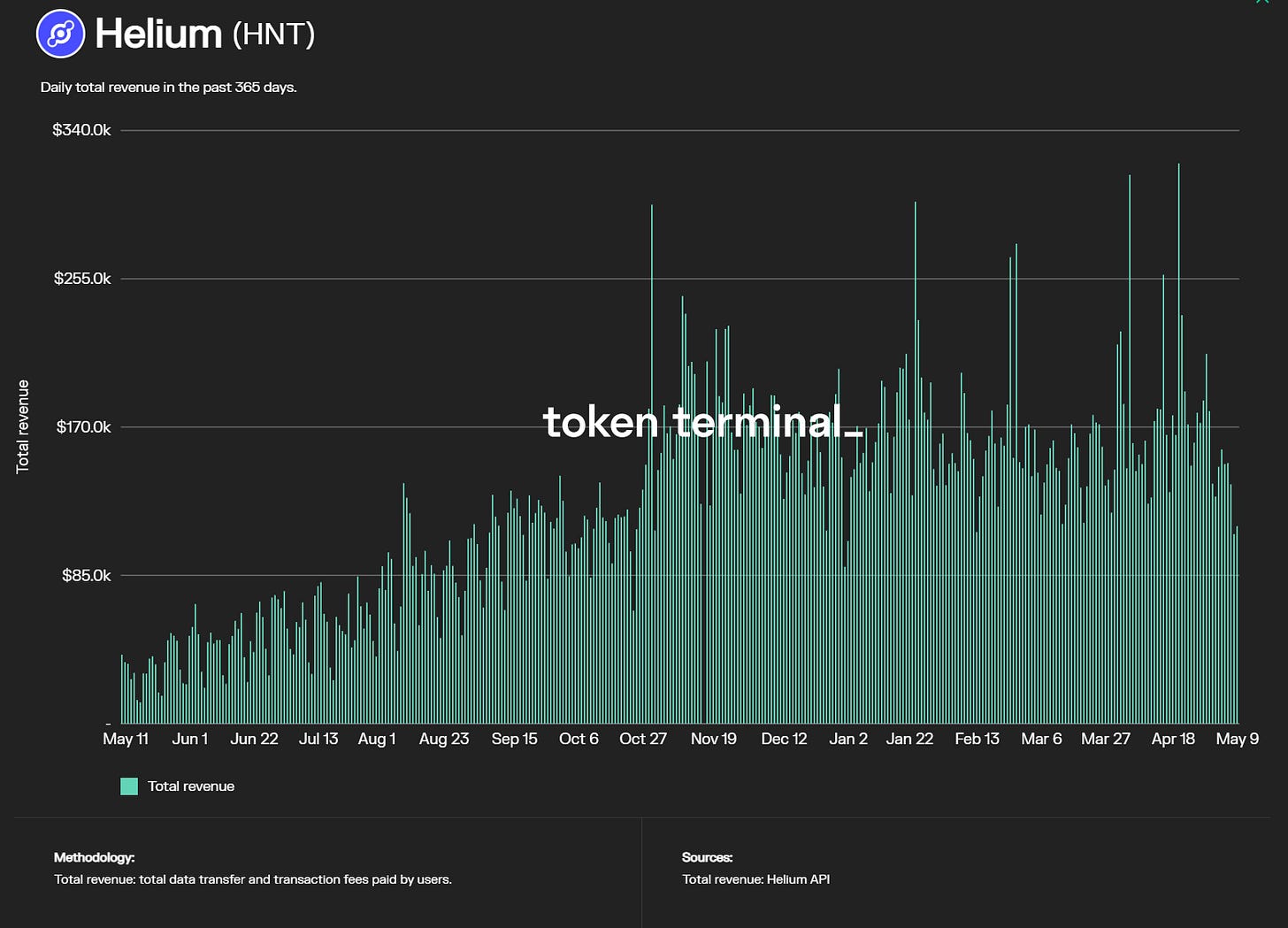

Here’s what the daily revenue over the last 365 days looks like. Despite linear growth in the no. of hotspots over the last 6 months, the revenue has stayed relatively flat.

For people who love numbers, the graphic below summarises key metrics that can be used for valuation. It helps to compare the data with competitors in the space or simply the industry standard but in the case of helium, there really isn’t a competitor one can compare to (perhaps there could be one that I’m not aware of).

The protocol is backed by some of the best investors in the space including Tiger Global, Panterra Capital, FTX Ventures, Khosla Ventures, and a16z among others. They recently raised $200M back in February at a valuation of $1.2B as part of their series D round.

The team has been collaborating with companies to expand their network usage dramatically. Some of the notable deals were with Microsoft where MSFT decided to partner up with Helium and use its network to reduce their Azure IoT Central infrastructure cost. In Europe, Techtenna joined hands with Helium to use its network to onboard new customers without the need for setting up new infrastructure.

Personally, I’m bullish on HNT and this isn’t meant to be taken as advice but as an opinion. They seem to be doing something unique and the initial traction they have looks promising!

With that, we come to an end and I hope this was informative for you. If you have any thoughts, opinions, or feedback to share, please feel free to respond to this email or share it in the comments. See y’all next time 🙋♂️